Wall Street Journal: Iran is greatly curbing its once-lofty ambitions to become a major liquefied natural-gas exporter, a reversal that energy executives and analysts tie to the country’s difficulty accessing Western technology amid fresh international sanctions.

Wall Street Journal: Iran is greatly curbing its once-lofty ambitions to become a major liquefied natural-gas exporter, a reversal that energy executives and analysts tie to the country’s difficulty accessing Western technology amid fresh international sanctions.

The Wall Street Journal

Officials suspend plans for two liquefied natural-gas projects as sanctions have foreign energy companies in retreat

By BENOîT FAUCON And SPENCER SWARTZ

LONDON—Iran is greatly curbing its once-lofty ambitions to become a major liquefied natural-gas exporter, a reversal that energy executives and analysts tie to the country’s difficulty accessing Western technology amid fresh international sanctions.

In several recent interviews with state-controlled outlets, Iranian energy officials have said they have suspended two of the country’s big LNG projects. Tehran said it is shifting its focus to building more gas pipelines.

Iran’s energy industry has long been hobbled by sanctions, a lack of foreign and domestic investment and technical challenges. Energy analysts have, in particular, viewed Iran’s timetable for becoming a major LNG power skeptically. Still, Tehran’s recent public statements about the program mark a significant shift for a government that has for years trumpeted its intention to create a significant LNG industry.

Officials haven’t publicly cited sanctions for the suspensions.

But the move comes as foreign energy companies retreat from plans to work with Iran. The LNG pullback could be an early indication that a series of new international sanctions—in particular those recently enacted by the European Union—are starting to bite, industry executives and analysts say.

Separately, Toyota Motor Corp. said Wednesday it had suspended car exports to Iran.

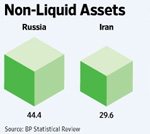

Iran is home to the world’s second-largest gas reserves, behind Russia. But Iran’s natural-gas exports are minor compared with those of Russia or Canada, and take place only by pipeline. The country could tap more markets and gain better bargaining power by selling LNG, a super-cooled natural gas that can be shipped by across the world by tanker.

Iran has boasted it could one day export as much as 90 billion cubic meters per year of LNG. That compares with the more than 105 billion cubic meters that Qatar, the world’s largest LNG exporter, plans to ship this year. Iran currently doesn’t export any LNG.

Iran’s LNG plans have been key to Tehran’s long-term goal of diversifying away from its aging oil fields as a source of export revenue.

In interviews with the Iranian oil ministry website, Shana, published Saturday and Monday, top Iranian oil officials said they would suspend the Persian LNG and Pars LNG projects. Both were being developed to take advantage of gas from one of the world’s largest gas fields, which Iran calls South Pars and shares with Qatar in the Persian Gulf.

In the Saturday interview, Ahmed Ghalebani, managing director of the National Iranian Oil Co., didn’t cite sanctions as a reason for the suspension. He said the national energy company was scrapping some LNG projects because they were too costly and complex. Iran would instead build more pipelines, he said.

Iran’s decision-making could have been influenced in part by the current cyclical glut in the LNG market, which has depressed prices in various parts of the world. But one Iranian gas official familiar with the projects said the most recent round of sanctions enacted by the EU, some of which target Iran’s energy sector, played a role.

The measures effectively prevent big European energy companies from playing a significant role in Iran. They also appear to make it harder for Iran to gain niche LNG technology through licensing arrangements from smaller European companies, analysts said.

“Sanctions are one of the reasons,” the Iranian official said.

Western companies, once eager to get in on Iranian energy development, have pulled back sharply amid Tehran’s recent standoff with the West over its nuclear program. Repsol YPF SA and Royal Dutch Shell PLC had been in talks to enter the Persian LNG project as foreign investors.

In June, Repsol dropped out of the discussions. At the time, Iran said it had contracted the gas development work to domestic companies.

A spokesman for Repsol said the company’s pullout was driven by “a portfolio decision” to focus elsewhere. Shell declined to comment.

Total SA of France, which had been in talks to help develop Pars LNG, has put off committing to invest, citing sanctions in the past. The company declined to comment.

Germany’s Linde AG has sold LNG technologies to another Iranian LNG project, which is nearing completion. But a spokesman said Wednesday that “given the current political environment, we do not consider new business opportunities in Iran.” He didn’t cite sanctions as a reason for the decision. It’s unclear whether Linde was bidding for work related to the two suspended projects.

Mehdi Varzi, president of a U.K.-based energy consultancy and a former Iranian oil official, said the new European sanctions effectively make the LNG projects unfeasible. Even independent European consultants appear to be barred from providing services to Iran’s oil and gas sector, he said.

Western companies have a stranglehold on LNG technology. That makes it difficult for countries not enforcing tough sanctions—like China—to fill the gap, Mr. Varzi said. The two suspended LNG projects can’t start “until the overall resolution of the nuclear issue,” he said.

NIOC’s Mr. Ghalebani and representatives at Pars LNG couldn’t be reached. Officials at Persian LNG didn’t return a request for comment.

Last month, the engineering subsidiary of Iran’s Revolutionary Guard Corps said it would pull out of two other South Pars gas-development projects unrelated to LNG. The unit was a target of new United Nations sanctions, and the move could have been an effort to protect the project—or foreign partners—from falling afoul of the new measures.

Mr. Ghalebani said the country wouldn’t abandon LNG projects altogether. Another large project, Iran LNG, is nearing completion and is expected to go online in 2012.

Western officials, meanwhile, have been on the lookout for signs that new U.N., U.S. and EU measures enacted in recent weeks are having any effect. Iranian officials and businessmen and executives across several major industries—including shipping, insurance and energy— have been trying to assess the ramifications of sanctions on their businesses.

U.S. officials have said the sanctions are already pinching Tehran. Independent reporting inside the country is greatly restricted, and it’s difficult to assess the moves’ significance so far.

One key indicator will be whether a new U.S. law aimed at curtailing foreign gasoline imports into Iran will cause any real pain for the government or Iranian consumers. Despite Iran’s oil wealth, the country has limited refining capacity and imports as much as 40% of the gasoline it consumes.

FACTS Global Energy, a Singapore-based energy consultancy, estimates that about six gasoline tankers dropped anchor in Iranian ports in July, about half as many as before the latest round of international sanctions. That is enough to meet demand, the consultancy says, as gasoline rationing has kept a lid on consumption.

The gasoline shipments were from Turkey and China, according to FACTS. Both countries said they would abide by U.N. sanctions but aren’t beholden to unilateral U.S. or EU measures. Iranian distributors can also find gasoline supplies, at a premium, from a flourishing black market for fuel products in the Persian Gulf.

“There is no evidence of a shortage in Iran,” said Fereidun Fesharaki, an Iranian oil specialist at FACTS.

Still, Iran must spend more for gasoline now than it did in early 2010, traders and analysts say. Cargoes headed to Iran are fetching at least 20% more than what they did at the start of the year, said one London-based oil trader, partly reflecting the higher risk premium of doing business with Iran.

The Iranian government “will have to keep paying these rates if they want gasoline,” the trader added.

—Kazuhiro Shimamura in Tokyo contributed to this article.